California State Senate Bill 1523

Passed the Senate JUne 16, 1976, Chaptered

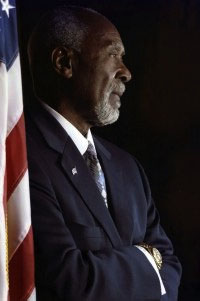

By Senator Nate Holden

CHAPTER.

An act to add Section 33675 to, and to repeal Section 33350.1 of, the Health and Safety Code, relating to community redevelopment.

LEGISLATIVE COUNSEL'S DIGEST

SB 1523, Holden. Community redevelopment: tax-increment financing.

(1) The Community Redevelopment Law authorizes redevelopment plans to contain provisions authorizing financing of redevelopment by allocation to the redevelopment agency of a portion of the property tax revenues produced by property within the redevelopment project area. The portion of tax revenues so allocated is derived from increases in assessed valuation of property in the project area occurring after adoption of the final redevel opment plan, and this method of financing redevelopment is known as "tax-increment financing."

This bill, with regard to redevelopment projects for which a final redevelopment plan is adopted on or after January 1, 1977, would require redevelopment agencies to reimburse affected taxing agencies so electing in the manner prescribed by the bill, for amounts allocated to the redevelopment agency under tax-increment financing which are attributable to increases in the tax rates within the project area occurring after the tax year in which the ordinance adopting the redevelopment plan becomes effective.

(2) This bill would provide that there shall be no reimbursement or appropriation for costs incurred by local agencies pursuant to the bill for a specified reason.

The people of the State of California do enact as follows:

SECTION 1. Section 33350.1 of the Health and Safety Code is repealed.

SEC. 2. Section 33675 is added to the Health and Safety Code, to read:

33675. (a) Prior to the adoption by the legislative body of a redevelopment plan providing for tax-increment financing pursuant to Section 33670, any affected taxing agency may elect to be allocated, in addition to the portion of taxes allocated to the affected taxing agency pursuant to subdivision (a) of Section 33670, all or any portion of the tax revenues allocated to the agency pursuant to subdivision (b) of Section 33670 attributable to increases in the rate of tax imposed for the benefit of the taxing agency which levy occurs after the tax year in which the ordinance adopting the redevelopment plan becomes effective.

- The governing body of any affected taxing agency electing to receive allocation of taxes pursuant to this section in addition to taxes allocated to it pursuant to subdivision (a) of Section 33670 shall adopt a resolution to that effect and transmit the same, prior to the adoption of the redevelopment plan, to (1) the legislative body, (2) the agency, and (3) the official or officials performing the functions of levying and collecting taxes for the affected taxing agency. Upon receipt by such official or officials of such resolution, allocation of taxes pursuant to this section to the affected taxing agency which has elected to receive the allocation pursuant to this section by the adoption of such resolution shall be made at the time or times allocations are made pursuant to subdivision (a) of Section 33670.

- An affected taxing agency, at any time after the adoption of such resolution, may elect not to receive all or any portion of the additional allocation of taxes pursuant to this section by rescinding such resolution or by amending the same, as the case may be, and giving notice thereof to the legislative body, the agency, and the official or officials performing the functions of levying and collecting taxes for the affected taxing agency. After receipt of a notice by such official or officials that an affected taxing agency has elected not to receive all or a portion of the additional allocation of taxes by rescission or amendment of the resolution, any allocation of taxes to the affected taxing agency required to be made pursuant to this section shall not thereafter be made but shall be allocated to the agency and such affected taxing agency

shall thereafter be allocated only the portion of taxes provided for in subdivision (a) of Section 33670. After receipt of a notice by such official or officials that an affected taxing agency has elected to receive additional tax revenues attributable to only a portion of the increases in the rate of tax, only that portion of the tax revenues shall thereafter be allocated to the affected taxing agency in addition to the portion of taxes allocated pursuant to subdivision (a) of Section 33670 and the remaining portion thereof shall be allocated to the agency.

- As used in this section, "affected taxing agency" means and includes every public agency for the benefit of which a tax is levied upon property in the project area, whether levied by the public agency or on its behalf by another public agency.

- This section shall apply only to redevelopment projects for which a final redevelopment plan is adopted pursuant to Article 5 (commencing with Section 33360) of Chapter 4 on or after January 1, 1977.

SEC. 3. Notwithstanding Section 2231 of the Revenue and Taxation Code, there shall be no reimbursement pursuant to this section nor shall there be an appropriation made by this act because self-financing authority is provided in this act to cover such costs.

Signed June 16th,1976 by Governor Edmund G. Brown